This is the third post in a blog series based on the applied research report, “Advanced Supply Chain Planning: Leading Edge Capabilities Needed to Win in 2030,” by the research team of Michael Burnette, Dan Pellathy, Karen Mathews, and Daniel Myers. Download the white paper.

In the first post of this series on supply chain planning, I wrote about why planning is more critical than ever for companies that want to succeed beyond today. In the second, I shared the GSCI End-to-End Planning Framework and nine maxims that serve as core principles for companies to develop their planning capabilities.

Through our research team’s in-depth interviews with more than a dozen leaders across nearly 20 industries, we also identified a set of seven leading-edge capabilities that will be critical to success over the coming decade. They represent a foundation for more advanced supply chain strategies, including resiliency, agility, and synchronization, for which planners are at the forefront.

Capability #1: Build an end-to-end, integrated supply chain through detailed mapping and validated constraint identification

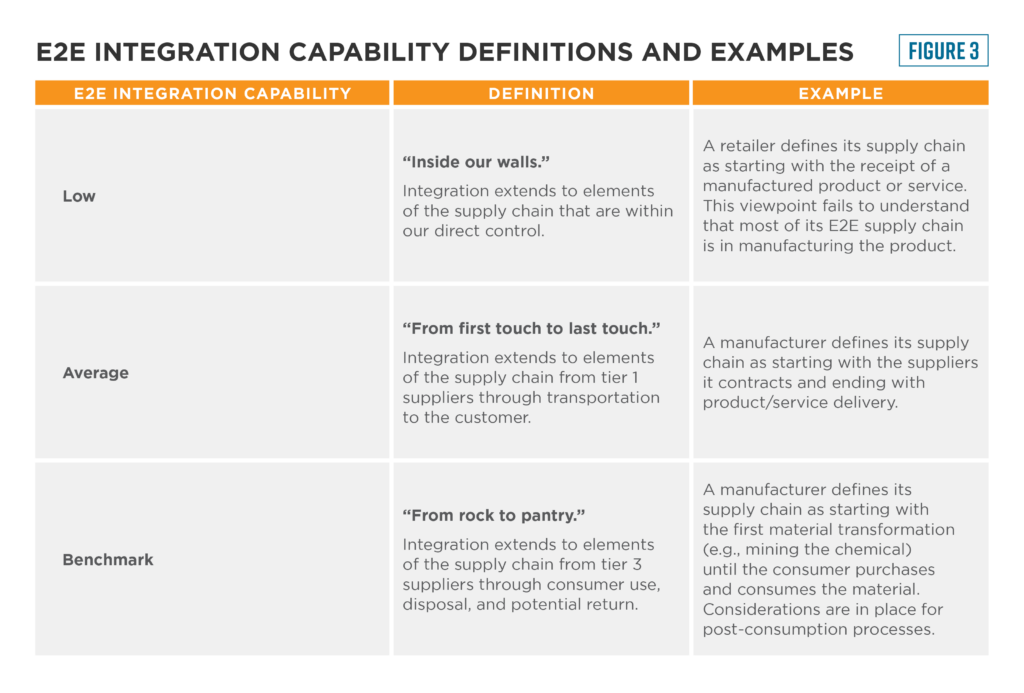

Several executives we spoke with described feeling confident about having fully integrated end-to-end supply chains until the COVID-19 pandemic struck. The disruption revealed that planners needed a more detailed understanding of critical nodes and transitions. Even more significantly, planners either needed to understand critical constraints or had misidentified them in the system.

The pandemic created higher demand variation, staffing shortages, and increased disruptions. Benchmark supply chains had to relearn the importance of maintaining a fully integrated system. Our discussions highlighted three critical takeaways from this experience:

- The issue of unexpected constraints. Benchmark supply chains assumed constraints had been identified and exploited. However, unexpected constraints emerged inside the enterprise and with partners due to staffing shortages, a lack of agility, and a need for more processes to manage regulatory changes.

- Lack of real-time, end-to-end demand/work process signals. Demand signals from DSI/S&OP processes or new orders were frequently forwarded to operations (manufacturing, warehousing) with an expectation that data would be shared upstream and downstream. However, communication often did not happen. The lack of a unified, real-time demand/work process signal created significant variation and waste in the system.

- The value of instantaneous capacity. Focusing on average capacity or capacity utilization measures created inflexible supply chains. Benchmark supply chains found that deploying instantaneous capacity was critical for enabling agility and meeting customer demand.

Leading-edge practices include mapping the end-to-end supply chain, aligning and educating the organization on the value stream, validating and managing constraints, creating a real-time information system and ensuring demand signals flow rapidly across it, and creating and managing instantaneous capacity to fill consumer/customer needs.

Capability #2: Focus on Strategic Planning and Complex Decision-Making by Automating Routine Planning Tasks/Decisions

Benchmark companies view rapidly expanding digital capabilities as critical to future success. Advancements in robotics, IoT-enabled warehousing, and driverless vehicles have significantly improved productivity in other supply chain functions. The goal is to avoid getting caught in the automation hype cycle and introduce digital capabilities that enhance productivity and decision-making.

Massive amounts of data, coupled with global information platforms and AI-enabled decision-making tools, have changed how planners guide supply chain systems. Technologies now track product and cash flows from suppliers’ suppliers to consumer delivery. However, more than data and tools are needed. Companies must leverage new technologies to automate routine planning tasks while elevating complex decision-making and strategic planning.

Capability #3: Respond with Agility to a Dynamic Operating Environment through End-To-End Supply Chain Visibility

Supply chain agility reflects how quickly a company can adjust operations to avoid disruptions while capitalizing on opportunities. Agility enables companies to thrive in uncertain environments. But to do so, they need a structured approach for identifying and funding projects that build internal capabilities and external relationships. This means making targeted investments that improve decision-making, process cycle times, and capacity optimization.

We outlined agility strategies in the white paper “Understanding and Valuing the Impact of Agility in Your Supply Chain.”

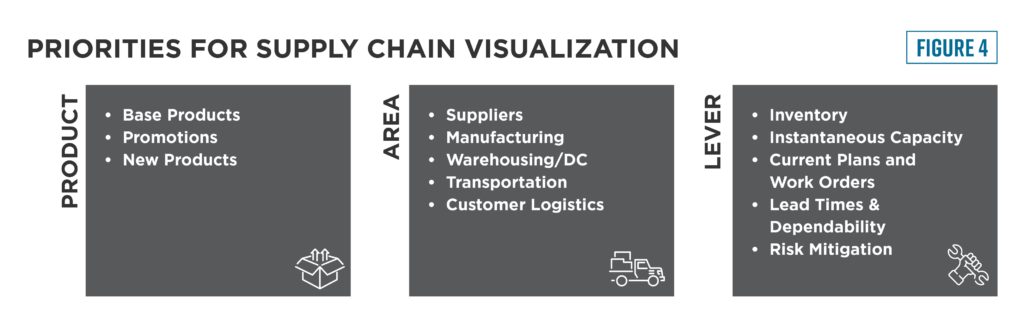

Visibility and dynamic planning and execution are requirements for long-term growth. Capturing data from disparate sources in the same format facilitates a complete view of supply chain performance, quick decision-making, and dynamic rebalancing of resources. It enables leaders to respond at appropriate time intervals during disruptions or as needed in normal operational periods. It also provides planning stability for inventory, capacity, and commitment status across critical suppliers and customer networks. Benchmark companies invest in end-to-end supply chain visibility to support a more agile response. These companies have created visualization tools that enable planners to quickly assess a situation and align teams to meet challenges as they arise. The adage “a picture is worth a thousand words” holds for complex supply chains.

Benchmark supply chains also invest in partnerships with companies creating world-class visualization tools for planners and SC executives. For example, a global Fortune 200 retailer has developed the capability to make current and planned future orders visible to enable its manufacturers to better plan for perfect customer service.

Capability #4: Optimize Outcomes through Seamless Integration with Commercial and Research and Development Functions, with Systematic Support from Finance and Analytics

Some questioned whether sales and operations planning (S&OP) or demand-supply integration (DSI) processes would survive the pandemic. Interviews revealed benchmark companies are committed to strengthening their S&OP/DSI processes. Indeed, S&OP/DSI processes have become the central business planning and integration tool to ensure the entire team is aligned with the work.

An essential feature of a company’s updates to their processes is integration between supply chain planning, commercial, and R&D teams. Supply chain leaders are not integral to shaping the strategic growth agenda in many firms. The job of the supply chain is to implement strategies with a strong focus on optimizing costs and improving operational efficiencies. After the pandemic, however, benchmark companies elevated the voice of the supply chain team, including critical vendors and supply chain partners, to develop plans that can deliver results.

Integration with commercial and research and development functions ensures that supply chain resources are available to execute current market plans. Supply chain planning must also establish the costs and investments needed to support new products and determine product/service business-case feasibility.

Product and service requirements impact the entire supply chain, from raw material procurement through the conversion process and out to logistics fulfillment. Supply chain considerations include supply strategy, logistics and distribution network optimization, and target launch dates and locations.

We have detailed strategies for demand-supply integration and supply chain integration in the white papers “Advanced Demand/Supply Integration Best Practices” and “Supply Chain Integration Strategy Best Practices.”

New digital tools have enabled planners to fully engage in data management, data analysis, options development/analysis, and strategic decision-making. Similarly, finance roles are changing. The days of rote work focused on accounting standards and historical ratio calculations are fading.

Leaders are demanding answers to critical questions:

- What is the value of time, agility, and customer service?

- What is the real cost of inventory?

- What is the value of resiliency in our supply chains?

No single functional area can answer these questions. They require information, understanding, and expertise that crosses organizational boundaries. Planning is at the heart of these cross-functional discussions. Many benchmark companies are moving corporate analytical talent into supply chain areas to ensure planning, finance, and analytics can be executed toward total value.

Capability #5: Have a Foundation for Automation, Analysis, and Decision-Making in Digital Capabilities, Especially Data Accuracy and Governance

Companies rely on structured data to drive decisions, even though more than 80 percent of the data that can significantly impact operations is unstructured (e.g., weather reports, political developments, supplier news, and financials). Fortunately, with advanced sensor and communications technology, collecting data has gotten much easier. Electronic sensing capabilities are advancing in size, durability, and frequency while companies continue finding innovative ways to collect data from customers, suppliers, and the marketplace.

Although less expensive than before, data collection and management still come at a price. Valuing resources and making investments that drive profits is a long-standing business competency. However, applying existing valuation techniques is more complex than valuing new equipment for manufacturing or distribution.

If current value is difficult to assess, future value is even more so. Today’s trend is to gather and store anything that is not cost-prohibitive. This method for determining what data should be collected is subjective. However, it can also be seen as a competency. Firms that acquire and leverage the right data types to support the right initiatives are more likely to achieve higher ROI on data collection efforts.

GSCI researchers outlined digital strategies in a previous white paper, “A Savvy Guide to the Digital Supply Chain.”

Capability #6: Be Responsive to Changing Market Conditions Based on Customer Service, Agility, and Time-Based Metrics

Metrics must reflect the reality of the operating environment. Leading companies agree that planning metrics should be based on customer service, time, and agility. Customer service metrics must reflect what customers value and how those values evolve.

Benchmark supply chains also understand the importance of time. Effective planners focus on eliminating non-value-added time by tracking it at every link in the chain, from new product introduction to supplier response, production, order fulfillment, and shipping. Time management lays the foundation for a more agile supply chain.

Planning is the most apparent process for supporting agility. A supply chain planning process that provides a common demand signal in near real-time facilitates a more responsive network. Likewise, a planning process synched to actual customer requirements will better adjust when those requirements change.

Many leaders we interviewed discussed planning as critical for agility. Metrics that revolve around demand sensing, collaborative relationships, process integration, and information sharing should be at the center of any planner’s dashboard.

We have detailed agility metrics and other strategies in two previous white papers: “End-To-End Supply Chain Synchronization: Orchestrating A Winning Strategy” and “Meeting the Challenge of Supply Chain Agility.”

Capability #7: Transform planning talent and leadership programs to advance competencies needed to implement benchmark supply chain planning capabilities.

To achieve leading-edge supply chain planning capabilities, the research team identified 11 core competencies professionals in the planning space will need:

- Data Analytics

- Technological Fluency

- Ambiguity Tolerance

- Change Leadership

- Negotiating Skills

- Awareness

- Compelling Communication

- Conflict Management

- Cultural Leadership

- Empathy

- Team Leadership

Benchmark supply chains often cited the need to improve data analytics and technology fluency competencies. With digitization, planners are expected to have an in-depth knowledge of data management. Planners will be required to rethink data, drawing on new forms of data acquisition, storage, and deployment. As cross-functional leaders, they will also be tasked with driving standardization and transferability of data across the supply chain.

At the same time, planners must have a detailed knowledge of emerging technologies. Artificial intelligence and machine learning are transforming the supply chain. Planners need to develop a critical understanding of the potential and pitfalls of these technologies. They will need to harness rapid advances to keep up with changes in the marketplace.

Managing through change requires talent development that encourages emotional and social competencies such as conflict management, cultural leadership, empathy, and team leadership.

In addition to identifying core competencies that planning professionals need to develop, the team identified five broad-based organizational action areas that can support the development of these competencies:

- Enhancing Storytelling and Communication

- Infusing Change Management & Influence Strategies

- Linking Diversity, Equity, and Inclusion (DEI) to Supply Chain Success

- Mentoring, Coaching, and Leadership

- Managing through Ambiguity

Leading companies estimate ROI from learning initiatives, and they hold business leaders accountable for employee success. When the approach is data-driven, tracked, and rewarded, it encourages faster development, addresses performance opportunities objectively and fairly, and empowers the employee to pursue personal growth. Organizational capabilities are complicated phenomena. They emerge from activities, processes, and routines that combine a company’s operational core and cultural values. It is not surprising that different types of individual competencies go into supporting an organizational capability. Tackling talent and leadership development issues is best thought of as a system transformation, focused on transforming the people systems at the foundation of future success.

The 21st century has charged out of the gates, accelerating the speed of business and increasing the supply chain capabilities required to win in the future. War, the post-pandemic recession, increased regulations, increased business expectations of supply chain leadership, and increased online sales are only some of the significant challenges facing us

Supply chain planning is at the heart of the most critical system transformations. Today’s planning professionals must be more comfortable managing ambiguity, leading change, and adapting to new technologies. Companies must be more proactive in providing educational opportunities and creating processes, metrics, and incentives that build professionals’ competencies in these areas.

If you’ve enjoyed this series, download the free white paper, where you will find more tables and figures as well as additional findings and examples of organizational design, supply chain complexity, and

To learn more about how your company can partner with us to explore advanced concepts in supply chain management, visit ASCC.

Download the white paper by filling out the form below to read more about meeting the challenge of supply chain agility.