By Alan Amling, PhD

This article is part 3 of a 3-part series explaining the what, why and how of Environmental, Social and Governance (ESG), its best practices and the ROI of integrating ESG priorities into supply chain management.

Generating a ROI (Return on Investment) is essential for the long-term sustainability of an organization. This 3-part series on Environment, Social and Governance (ESG) in the supply chain would not be complete without addressing ROI. ESG and ROI cannot be separated; they are two sides of the same coin.

Part 1 in this series explained the what, why and how of ESG. Part 2 delved into best practices of companies leading the way in ESG. In this final installment, we get to the bottom line, the ROI of ESG.

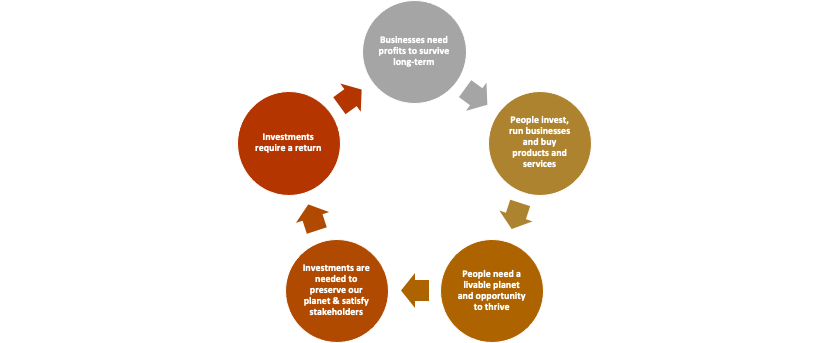

While there is much debate on ESG goals and how to reach them, there is general agreement on five fundamental truths (see Figure 1).

Ultimately, ESG is about the long-term sustainability of people – all the stakeholders in any business. BlackRock CEO, Larry Fink, explained this point clearly in his 2022 letter to CEOs.

“Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper. This is the power of capitalism.”

-BlackRock CEO Larry Fink’s 2022 Letter to CEOs

Let’s begin exploring the ROI of ESG with an overall picture of the investment needed to meet the Paris Agreement objective of capping the rise in global temperatures at 1.5 degrees Celsius.

The Big Picture

A 2022 report from the International Renewable Energy Agency (IRENA) showed that planned investment in clean energy must increase to a total of $131 trillion by 2050 to cap the rise in average global temperatures at 1.5 degrees Celsius. IRENA estimates that every dollar spent on the transition from fossil fuels to renewable energy should yield benefits valued at between $2.00 and $5.50.

These figures are daunting, but they are only part of the big picture. Ultimately, people decide what companies, communities and countries do to protect the planet, profits and their specific interests. E, S and G are inextricably linked and require tradeoffs. For example, banking giant HSBC stepped up its climate actions to avoid a shareholder revolt in 2021. As a result, HSBC also began leaving profits from thermal coal customers on the table.

There is no one “right” ESG path. As discussed in Part 2 of this 3-part series, a firm’s ESG actions should reflect the company’s mission and strategy. While tradeoffs are inevitable, it’s important to remember that ESG and ROI are two sides of the same coin.

Your Picture

So how will companies invest to reach their ESG goals while continuing to generate profits that sustain their business, employees, customers and communities? Let’s look at this from the perspective of an individual considering whether to purchase an electric or gas-powered vehicle.

The choice between purchasing an Electric Vehicle (EV) versus. a gas-powered vehicle exemplifies some of the tradeoffs (see Figure 2). The ROI of an EV purchase depends on many factors, including government incentives, insurance costs, maintenance costs and fuel costs. These costs will vary depending on where you live and your driving requirements. However, the primary determinant of ROI will be your expectation of fossil fuel costs over time. The higher the cost of fossil fuel, the higher the ROI of your EV purchase.

| Higher EV Costs | Lower EV Costs |

|---|---|

| •Higher Purchase Cost •The average transaction price for an electric vehicle is $15,000 higher than the industry average according to January 2022 Kelley Blue Book data. •Federal tax credits of as much as $7,500 could reduce this disparity. •Higher Insurance Cost •Insurance for an EV could cost as much as $124 per month more on average. •However, according to the Insurance Information Institute, this gap is closing. | •Lower Maintenance Cost •According to AAA, annual maintenance for an EV is $330 less than a gas-powered car •Lower Fuel Cost •While gas and electric charging costs vary by location, Consumer Reports has pegged the gas-price-equivalent fuel cost for an EV at $1.40 per gallon. •Further, Kelly Blue Book estimates you will pay an extra $56 per month for every dollar gas prices go up. |

Source: Wolfe, Rachel, “Thinking of Buying an EV as Gas Prices Surge?”, Wall Street Journal, March 10, 2022

From a company perspective, expectations regarding future costs will play heavily into the ROI calculations of ESG investments. For example, how will:

- Geo-political events impact both access to and the cost of energy?

- ESG performance impact both access to and the cost of capital?

- Environmental and social policies impact consumer purchasing behavior?

- ESG shocks such as cybersecurity breaches, human rights violations and extreme weather events impact investment returns?

- Consumer purchasing behavior evolve in relation to company ESG performance?

- Governments incentivize the transition to sustainable energy?

The ROI of ESG

Companies generate an ROI from investments by increasing revenues, reducing costs or both.

ROI = (Net Return on Investment (Revenue – Cost)/Cost of Investment) x 100%

These up-front investment costs draw from net earnings, borrowing or issuing equity capital. Fortunately, the 450 financial institutions in the Glasgow Financial Alliance for Net Zero (GFANZ), which control $130 trillion of private money, have committed to accelerating the transition to a net-zero economy by 2050. As a result, 2021 investment in ESG funds worldwide hit $649 billion, more than doubling the investment in 2019.

Other ESG stakeholders will also play a role in funding up-front investments. Local, state and national governments may offer financial incentives to bolster ESG investments. They may also charge companies for their emissions through various regulations and taxes. Long-term sustainability will require consumers to fund ESG investments directly or indirectly through product and service purchases.

Generating an ROI on ESG Investments

The connection between ESG and financial performance is well-studied. For example, a research team from the NYU Stern Center aggregated findings from more than 1,000 research papers published between 2015 and 2020 and found that 58% of the studies showed a positive relationship between ESG and financial performance, with only 14% showing a negative relationship.

So how do ESG investments increase revenues, decrease costs or reduce risks for organizations? The following section outlines six levers companies can pull to generate an ROI from their ESG investments.

1. Win-wins: the low-hanging fruit

ESG investments that create an immediate payback should be a priority. A typical example is switching from incandescent bulbs to light-emitting diodes (LEDs). LEDs use up to 90% less energy and last up to 25 times longer than traditional bulbs.

Investing in employee relations is another win-win. A recent Gallop poll showed that employers with highly engaged teams, those given clear expectations and the tools and support to get the job done, generate 21% greater profitability. Further, those companies in the top 20% in employee engagements realized a 41% reduction in absenteeism and 59% less turnover. When you consider the cost of replacing an individual employee can range from one-half to two times the employee’s annual salary, the impact on a company’s bottom line becomes apparent.

An additional win-win investment is reducing waste. For instance, leading supply chain companies are leveraging advanced technologies to create more efficient delivery routes, reduce “dead miles” of underutilized truck capacity and reduce wait times for delivery drivers to unload. These actions allow companies to do more with less, improving ROI. UPS, for instance, saves an estimated 100 million miles and 10 million gallons of fuel each year through their route optimization solution known as ORION. This focus on improving efficiency to drive down costs and improve ESG performance is brought to life in the following Maine Pointe case study.

Case Study: Partnering for Success

Working with one of the largest integrated energy companies operating one of the largest aviation departments, management was aware that they were excessively using third-party charter services and that utilization of their own fleet was suffering. In addition, one of their five core values was Sustainability which was not being translated into actionable results across their supply chain. The challenge was clear – take costs out while still servicing 250,000 passengers a year, meeting the needs of business units across five locations, maintaining a safe operation, and improving their sustainability measures. To address this challenge, senior executives determined additional help was needed and ended up turning to consulting firm SGS-Maine Pointe for answers.

To meet the dual requirements of both profit and planet, SGS-Maine Pointe combined a proven supply chain and operations optimization approach with a complementary ESG framework. The Total Value Optimization pyramid synchronizes efforts in procurement, logistics and operations. Likewise, the ESG pyramid coordinates the three pillars of environmental, social, and governance initiatives. Think of it as a balanced scorecard for you ESG journey.

The journey begins with a clear understanding of your starting point. For example, do you have an ESG strategy in place or are your ESG decisions purely reactive? Alternatively, you may already have gained alignment with the broader company strategy covering all material ESG risks and opportunities. Regardless, it’s not where you start, it’s where you end up.

After a thorough analysis, it was evident that significant change was necessary across several areas of the energy company’s aviation division, including fuel use, crewing, maintenance and scheduling. Virtually every KPI indicator was incorrect or inaccurate, and unfavorable against industry benchmarks. There were no systems in place for yield optimization, crew scheduling, maintenance, fuel conservation or timetable planning. Therefore, SGS-Maine Pointe deployed a multi-faceted solution which:

- Focused on reducing the number of charters and optimized owned assets

- Worked with business units to develop an agreeable flight schedule which optimized load factor and asset utilization

- Created an Operations Control Center (OCC) for continuous monitoring and management of all aviation-related processes

- Developed an operational dashboard with key metrics and a meaningful, accurate scorecard including tracking carbon reduction

- Developed a system for crewing the aircraft more efficiently with better coverage

SGS-Main Pointe also engaged the company’s stakeholders both inside and outside the company. Passenger feedback led them to open up two additional destinations, as well as an “Aviation Users Group” for key stakeholders to meet monthly ensuring on-going optimization of the service.

The results provide a concrete example of improving profits and planet at the same time:

- Annualized Savings of 20%

- Own aircraft utilization improved by as much as 96%

- 8% improvement on fuel efficiency and an overall fuel use reduction of 28%

- A reduction in carbon emissions equivalent to 2,173 passenger vehicles taken off the road

- Improved load factors from 39% to 55% (despite year over year volume being down)

- Return on investment of 7:1

2. Lower your risk, lower your capital cost

The ROI denominator, investment cost, will increasingly be determined by ESG performance. As consumers, we pay less for loans if we’re considered low-risk, as measured by our credit score. The same is true for companies and their ESG scores. Global financial company MSCI conducted a four-year study on the impact of ESG performance. They found that companies with high ESG scores had lower capital costs, equity costs and debt costs than those with low ESG scores.

3. Avoid costly events that erode your returns

Many ESG failures at public companies have not been transparent to investors and consumers and have had a limited financial impact. That’s changing. In March 2022, the U.S. Securities and Exchange Commission announced comprehensive climate disclosure rules. In the same month, President Biden signed a requirement for critical businesses to report to the government when they have been hacked. This transparency will allow investors and consumers to compare ESG practices and performance between companies more efficiently.

The first article in this series used the cautionary example of Boohoo to show how swiftly and severely ESG failures can impact a company. The U.K. online fashion retailer lost over $1.5 billion in market value on a single day after poor working conditions at one of their garment manufacturers were disclosed.

Companies also don’t want to be caught off-guard if and when carbon trading markets impact their business. Since the price of carbon is zero today, most companies don’t realize how significant the liability may be. A 2021 Harvard Business Review article indicated that the price of carbon could be between $50 and $100 per ton in the near term. Under these conditions, a company like ExxonMobile would owe $11 billion annually based on their 2020 emissions.

Putting a price on carbon may be coming sooner than most companies realize. The European Union unveiled its carbon trading plan in July 2021, setting the price per metric ton of emissions at $68. The fee would apply to domestic companies and producers outside of the EU based on the carbon content of their products sold in Europe.

4. Reduce fuel price risk

While a few nations control the global supply of fossil fuels, the world has access to solar, wind and other renewable energy sources. With fossil fuel prices fluctuating wildly based on geopolitical conflicts, natural disasters and the desires of a few major oil-producing countries, renewable energy prices have steadily fallen since 2010. A World Economic Forum study showed that between 2010 and 2019, the price per megawatt-hour of electricity from solar dropped over 80%, from $378 to $68, while offshore wind power fell 29% and onshore wind power dropped 38%. Companies have reduced the risk of high fluctuations in fossil fuel costs by incorporating more renewables. While fossil fuels still dominate U.S. energy consumption, renewable energy is the fastest-growing energy source in the U.S., increasing 42% between 2010 to 2020.

5. Reduce labor costs and improve productivity

The economic impact of ESG’s Social component became more apparent through 2021 as labor availability and costs became a limiting factor for businesses worldwide. Between April and September 2021, more than 24 million American employees left their jobs, an all-time record. Dozens of studies have shown how ESG actions can help companies win the battle for labor and improve productivity.

Creating a culture and processes that support employees is critical. For example, a 2019 study from the Governance & Accountability Institute showed that 70% of the Millennial employees surveyed prefer working for companies with a robust environmental plan, and a good portion of these workers would take a pay cut to do it. Additionally, a toxic corporate culture is ten times more important than compensation in predicting turnover in an organization. Elements that contribute to a poisonous culture include failure to promote diversity, equity and inclusion; workers feeling disrespected; and unethical behavior.

6. The rising tide of ESG: expand the available market for your products and services

ESG investments can prop up underserved parts of the market, increasing the buying power of these communities. Professors Andrea Sordi and Wendy Tate of the University of Tennessee, Knoxville, have studied the impact of economic inclusion and supplier diversity on ROI and note that traditional supplier diversity programs are measured by the percentage of spending with diverse suppliers. However, the added element of economic inclusion considers the economic ripple effect of these programs.

CVS Health, for example, purchased $3.4 billion from small and diverse businesses in 2020. The direct impact of those purchases supported 46,238 jobs in the CVS Health end-to-end supply chain and $2.2 billion in wages and benefits at these businesses. These small and diverse businesses then purchased $1.4 billion in goods and services from their suppliers, supporting over 8,000 more jobs. In addition, the employees in supported positions generated about $1.5 billion in economic activity and another 11,000 jobs in their communities.

ESG in the Supply Chain: Final Thoughts

In this three-part series, we began by addressing why ESG is a critical issue, impacting a company’s growth, bottom line and ability to attract and retain talent. It was also highlighted that just like R&D and saving for college, ESG is an investment. The second article explained how companies implement ESG to drive results. This final article addresses the elephant in the room, generating ROI from ESG investments. While some actions will generate immediate returns, most will require near-term investments to produce long-term results. Ultimately, consumer behavior will drive the ROI of ESG. Consumers will have to break habits developed over a lifetime around the energy they use, the food they consume and the businesses they support.

Valid arguments can be made that the near-term cost of transitioning to carbon-free energy will cost consumers more. However, as the Russian invasion of Ukraine in early 2022 showed, our addiction to fossil fuels creates costs as well.

Ultimately, all stakeholders will need to work together to realize a sustainable future for our people, planet and companies. ESG and ROI cannot be separated; they are two sides of the same coin. Use the information in this three-part series to begin or accelerate your ESG journey.